Wage Garnishment: Finances under control?

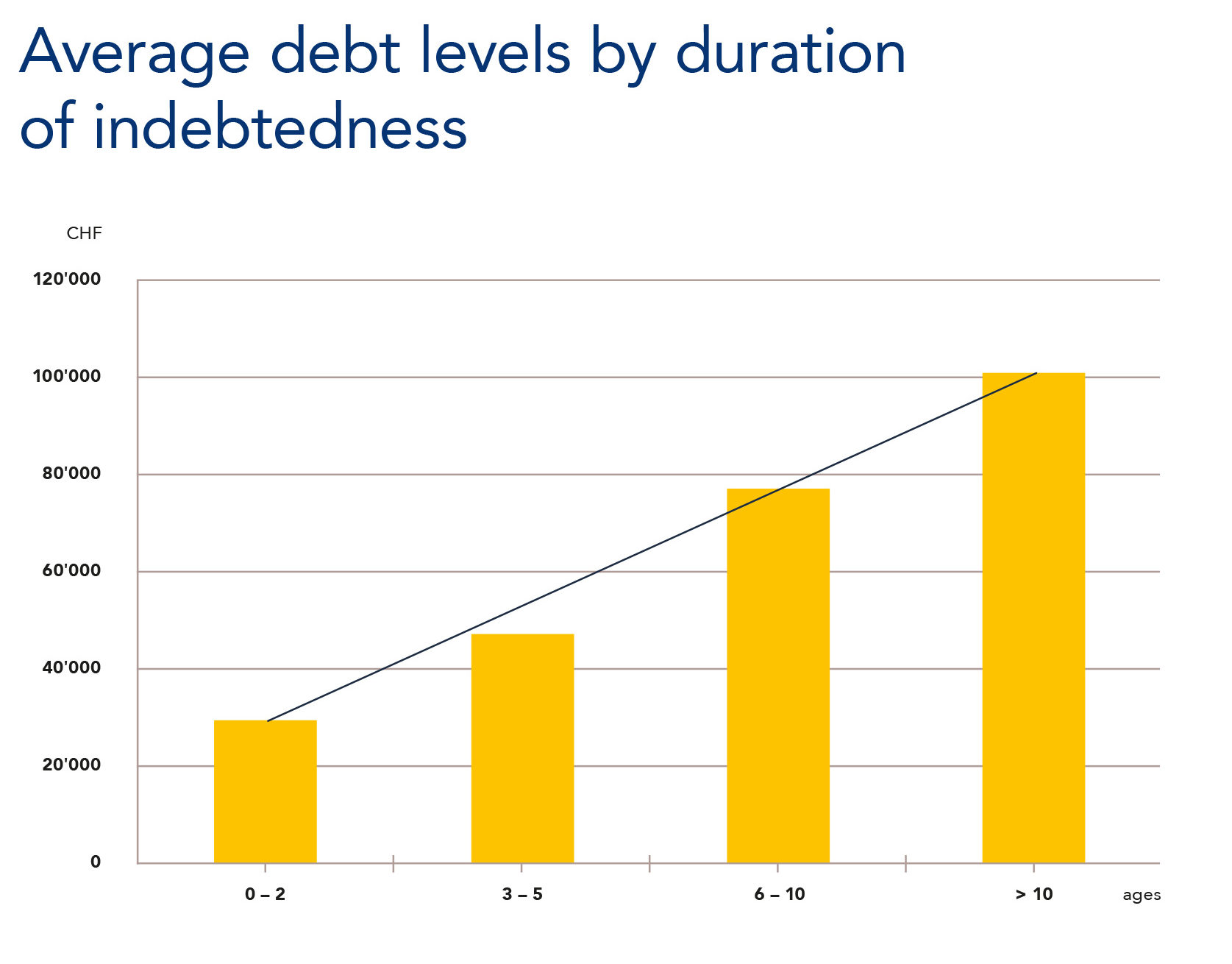

But what does that even mean, wage garnishment? The employer must transfer the share of the salaries exceeding the subsistence level directly to the debt collection office. This includes the 13th monthly salary and bonuses. Employees affected by the measure will only receive the minimum amount necessary according to the calculations of the debt collection office: to pay the health insurance premiums, electricity bills and a modest subsistence. Saving is no longer possible. Frequently, further debt collection proceedings are initiated under such circumstances, which is why the level of debt often rises in the context of lengthy attachment proceedings (see chart).

source: schulden.ch

Here you can calculate your own subsistence level in a debt collection context

Wage garnishment does not happen over night. Often and for quite some time, those concerned believe they have everything under control – before suddenly everything changes.

Crushing fixed costs, personal crises, changes in income: those are the reasons that lead to wage garnishment. This is when many of those affected feel humiliated: the employer becomes aware of the financial problems of their employee; all financial matters must be disclosed to the debt collection officers; there is no financial leeway in everyday life.

Can wage garnishment prevented?

It very much depends on the point of time. Financial problems are often ignored. Many people are not aware that taking out a loan will only increase their problems rather than solve them. Many people only admit they no longer have their finances under control after they have received several notices from debt collectors. Often, debtors have no overview of their entire amounts owed.

What to do when facing wage garnishment?

Many feel overwhelmed and bury their heads in the sand. However, it would now be important to get an overview of their own financial situation. How much do I owe? How can I prevent further debt? Are there any options for me to restructure my debt?

These 6 measures in dealing with money can help you control your finances:

1. Know how much you spend: Writing down your monthly expenses will help you get an overview of your finances. Be aware of your fixed costs, as they generally make up a high proportion of your expenses.

2. Plan your budget: After you have put down your expenses draw up a monthly budget. Whatever you earn minus whatever you spend is your monthly balance.

3. Build up reserves: Start saving for larger planned expenses such as holidays and dental bills and build up reserves for unplanned expenses such as car repairs or additional costs at the end of the year.

4. Automate your cash flows: Set up standing orders for planned reserves or savings.

5. Change your habits: Avoid impulse and bargain purchases. Before deciding to buy something sleep over it. Think ahead: You may be on the road longer tomorrow after work. Perhaps it makes sense to pack a water bottle instead of paying a high price for it at a convenience store.

6. Get advice early on: The earlier you look for support the easier it is to avoid wage garnishment. Proitera’s team will be happy to assist you.

Our recommendations for companies:

- Employees who repeatedly ask for advances should be strongly encouraged to consult a budget advisory service. Provide them with a specific address with a telephone number. Proitera will be happy to provide your partner companies with flyers.

- Grant personal loans only in connection with a budget advisory service and on their recommendation. A loan will not solve all problems!

Further useful information and leaflets:

- dettes.ch, Statistiques 2015 de Dettes Conseils Suisse

- Statistik 2015 der Schuldenberatung Schweiz, Steuern und Überschuldung

- schulden.ch, nützliche Informationen, Briefvorlagen und Adressen von Beratungsstellen.:

- Beobachter, Lohnpfändung – Leben mit dem Existenzminimum

- Ktipp, 10 Fragen zur Lohnpfändung

- geldverstehen.de, Finanzen in den Griff bekommen

- mission-rendite.de, Finanzen in den Griff bekommen – So schaffst du es!